In this issue...

News

- A sea of creativity: Year 10 artists inspired by Bondi’s sculptures

- Young thinkers excel at the Mindquest enrichment program

- Young writers shine in the NSW WriteOn competition

- A backstage adventure: students capture their creative crew experience

- Celebrating creativity in Dorothea Mackellar Poetry Competition

- Shire robotics students recognised at assembly for teamwork, grit and grace at nationals

Notices

- Shire Storytime for Preschool Aged Children – Thursday 27 November

- For One Night Only – Still Time to Book Tickets – Thursday 13 November 7pm

- Employment Opportunities

- Subway available to order on Mondays and Fridays

- What's on - Term 4, Week 5 and 6

- Confidential Feedback

- Edstart - an alternative fee payment option

From the Principal

Government Funding and School Fees

Government Funding and School Fees

In the recent parent survey, we received the following comment: “What is the forecast for fees ... please don't tell us that it is all dependent on the amount of money flowing from the Federal Government.”

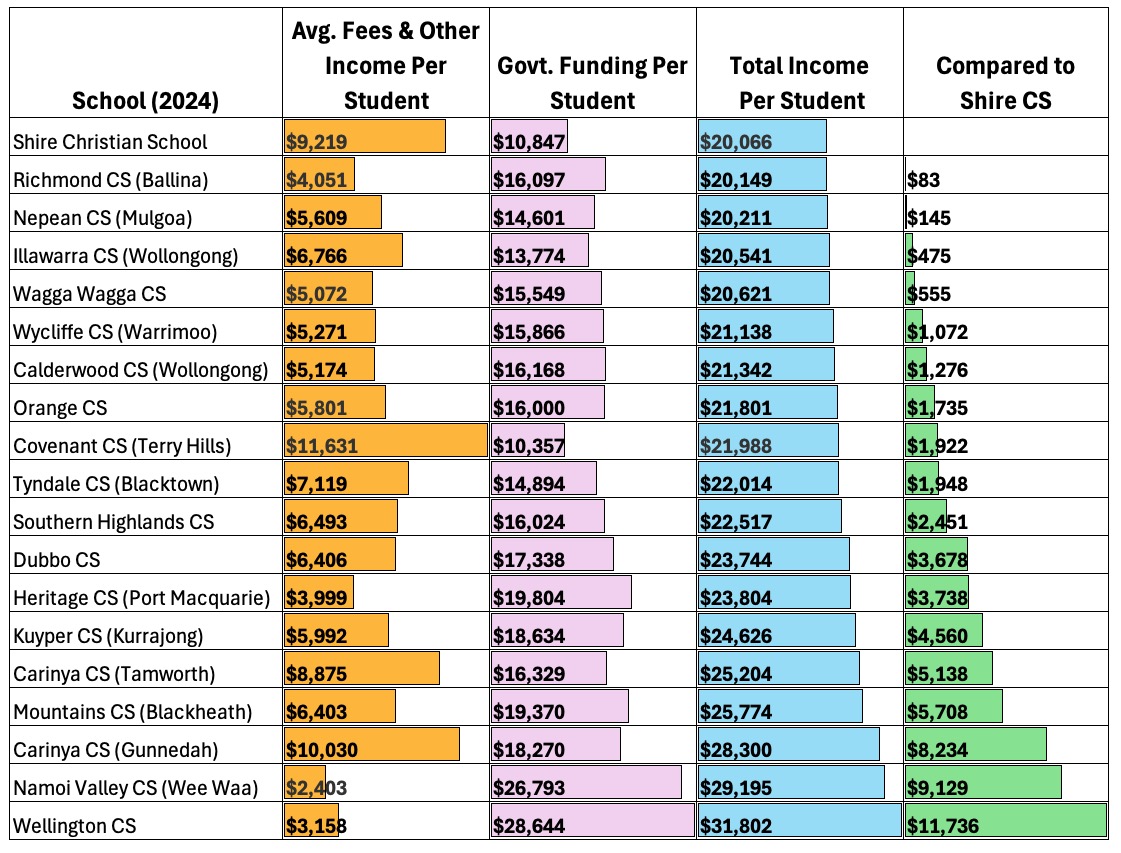

We are working on our fee forecasting; however, government funding remains the major driver of fees at our school, and I’d like to show you why. The table below is compiled from publicly available data on the MySchool website and shows the 19 CEN Christian schools in NSW:

You can see that while all but two of the schools have lower fees than us, most of the schools are funded at significantly higher levels, meaning that even with lower fees, they still receive a higher overall income per student than Shire does. So, for example, despite Calderwood CS having significantly lower fees, they are taking in almost $1300 more per student than we are. With over 900 students in our school, that would amount to an additional one million dollars available for resourcing the organisation.

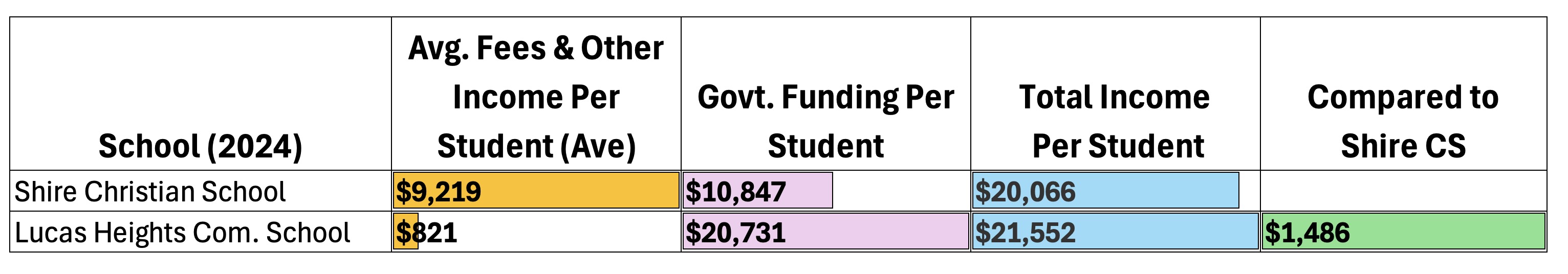

This puts us in the position of having the lowest per-student income available for teaching and learning of any CEN school in NSW. Equally revealing is the comparison with our neighbouring government school:

In contrast to media messages about private schools diverting taxpayers’ money from public education, Lucas Heights costs taxpayers twice as much as Shire, and is actually resourced at $1500 per student more than we are.

This data shows what an incredible job is being done at Shire to provide the range of educational offerings that we do. Our Christian teachers are passionate and invest deeply in each student. Our parent survey showed that 98% of parents’ expectations regarding Christian Education were exceeded or met. Over 90% of our parents told us that our facilities and co-curricular offerings meet or exceed their expectations. And while we continue to work on improving our HSC results, our graduating students consistently demonstrate that ATARs in the high 90s are achievable each year. I am proud of Shire Christian School's achievements and confident that our students graduate well-prepared for life beyond school.

We do all of this on less income than so many other schools, but with escalating operating costs and staff salaries, it is increasingly hard to maintain our services at these fee levels. I also know that many parents would like more subjects offered, more co-curricular and enrichment opportunities, and reduced class sizes; however, with fixed (and declining) government funding, the entire cost of these would have to be raised through school fees. For example, reducing K-6 class sizes by four students would cost close to $1 million, adding over $1,000 to the school fees of every child from K-12.

Non-government schools are funded based on a CTC score, which stands for “Capacity to Contribute”. The Department of Education sources income data from the ATO for all the school’s families to calculate how much it considers parents can contribute, based on their economic status. The funding is not dependent on what fees we charge or the cost of living or housing in the area, only on the taxable income of our parents. This document from the Department of Education shows the assessed median family income for each non-government school, with Shire Christian standing assessed at $195,000.

Historically affordable Christian schools such as Shire CS, St George CS and Covenant CS, which are situated in regions of Sydney with a higher CTC, are facing tough choices as our funding is reduced as a percentage of overall income. We are committed to running a financially efficient organisation wherever possible, and we are also mindful of a future in which we need to be less reliant on declining government funding. Please keep the Board and the school leadership in your prayers as we navigate this challenge to ensure that Christian Education in the Shire remains accessible and sustainable for generations to come, to the glory of God.

Mr David Stonestreet

Principal

From the Deputy Principal

Compass Attendance Procedures

Compass Attendance Procedures

With Compass now up and running, here are a few helpful tips and procedures to ensure our rolls are accurate and our students are well cared for.

Attendance

Education is important and regular attendance at school is essential for your child to achieve their educational best and increase their career and life options. Our school works in partnership with parents and carers to encourage consistent school attendance which supports learning and helps students to develop lasting friendships. The school is legally required to keep an accurate record of attendance.

Following an absence, you must provide an explanation of the absence within seven school days. Lateness is recorded as a partial absence and must be explained by parents or carers.

Compass Attendance Procedures

Absence – Parents are sent an SMS on the day of their child’s absence. A parent should click the link and respond with a reason for their absence. Do not reply to the SMS, click the link. The absence will be marked as unexplained if a response isn’t received within 7 days.

Late arrivals – You can use the Compass app to lodge an attendance note or respond to the late arrival SMS. All students must sign in at the office if they are arriving late.

A late arrival is any time after 8.20am for Secondary students and 8.40am for Junior School students.

Early Departure – All Junior School students need to be signed out at the office by a parent.

All Secondary School students must sign out at the office or a parent can sign the student out.

Compass Attendance Notes – You can lodge attendance notes anytime to give a reason for your child’s absence, late arrival or early departure using the Compass app in advance or as required.

Using Favourites

Use the favourites buttons to access these areas quickly and easily.

Attendance – access and lodge attendance notes

Chronicle – discover entries lodged by school for your child

Events – keep up-to-date with the school events your child is attending

School Documents – access helpful school documents

School Favourites – 01. User guide, 02. Parents Information (uniform, subway, school information etc.), 03. Update details – update contact information, photo permission (links to an external system, this will be done natively in Compass next year)

News Items

We will be posting important information here each week to help keep parents updated with events and notices. This will reduce emails to your inbox. Parents will be alerted to high importance notices by email/push notification.

Notifications

Click notifications to see information about your child’s academic results, events or pastoral care entered for your child.

Mr Paul Carter

Deputy Principal

From the Academic Head

World Teachers’ Day Teaching Gems

World Teachers’ Day Teaching Gems

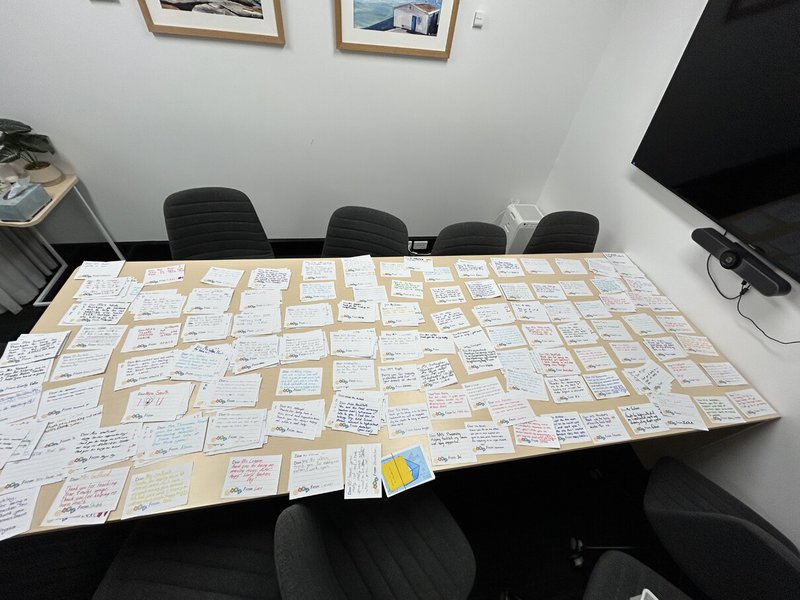

Shire Christian School had 96 World Teachers’ Day Teaching Gems pinned to the map on NESA’s website. Thank you to our school community for taking the time to write such encouraging messages.

Here are some photos of our students in the breezeway, “secretly” writing thank you cards for our teachers. Thank you to our Year 6 and Year 12 Student Leadership Teams for coming in early during the week to help me with this very special task. On Friday morning, every teacher received a handwritten, heartfelt message of thanks on their desk from our students. Teachers were also spoilt with a beautiful bacon and egg roll breakfast on Friday morning. We definitely felt appreciated, and love what we do here at Shire Christian School.

Mrs Rachel Robinson

Academic Head

Ready to Review

Ready to Review

Last week K-12 teachers engaged in an afternoon of professional learning, exploring our new disposition of “Reviewing”. We started by watching a short, humorous Pixar animation called “Geri’s Game”, in which an older gentlemen plays chess at the park. It’s a great clip to talk about reviewing because the game of chess only works when the character reviews every single move. Spoiler alert: he is the only player of this game.

Breaking up the word review into its parts, we see that “re” means “again” or “back” and “view” means “to see” or “to know”. This skill belongs in our Reflective Domain, in which we practise the skill of revisiting something and not accepting our first look or opinion as the only viewpoint or one that you stick with. The visible thinking tool, “I used to think…but now I think…” is such a helpful phrase to help us to review a situation.

In fact, there are many examples throughout the Bible of when someone reviews their situation. Such as Jonah, whilst inside the belly of a fish, reviewing his decisions whilst praying. Or Nicodemus, a Pharisee who had to visit Jesus at night so that others didn’t see how confused he was when Jesus was preaching about needing to be “born again”. Nicodemus needed to review his understanding and seek the wisdom of Jesus to help him see things anew.

Perhaps the most obvious one is Saul’s conversion on the road to Damascus, upon hearing Jesus and rendered blind for three days. Then, upon meeting Ananias, Saul was filled with the Holy Spirit, the scales fell from his eyes and he was able to see again. Imagine the reviewing he did about what he saw, changing from a “persecuting lens”, to a “loving and gracious lens”, filled with hope in Christ.

We can be encouraged to review what we see and think, and take time to really look again and be open to changing our thoughts and opinions.

Mrs Rachel Robinson

Academic Head

From the Head of Secondary

Inaugural Showcase Event for Years 7 to 11

Inaugural Showcase Event for Years 7 to 11

As we alluded to earlier on this year, we are hosting our inaugural Showcase Event for Years 7 to 11 next week. There will be a collection of student work from throughout the year, across all subject areas. It will be held in the Secondary Library and open on the day of For One Night Only, Thursday November 13.

There will be two sessions that parents, family and friends can attend. The event will be open from 2pm to 3:30pm, allowing those who would normally be collecting their children at the end of the school day to visit. It will then reopen at 5:30pm and continue until 7pm when the For One Night Only program will commence. A sausage sizzle will be available during the later session for families wishing to purchase food before the evening's music night begins.

While this Showcase will be a chance to see learning from many students, teachers will be informing students if their work is being displayed. Unfortunately we do not have the capacity to show work from every student on this occasion. In future years we will explore how we can best celebrate work from all these year levels seeing as the HSC Showcase only features work from Year 12.

We are currently finalising information for Year 10 Global Awareness Week and Picnic Days for other year groups. All parent permissions will be collected through the Compass App, so we encourage all families to make sure they have it installed. We are already seeing some time saving benefits with this new system.

Mr David Collins

Head of Secondary School

From the Head of Junior School

Cultivating Patience and SocS

Cultivating Patience and SocS

Cultivating Patience

“Be completely humble and gentle; be patient, bearing with one another in love.” (Eph 4:2) Patience is a virtue that doesn’t come easily for many of us, making it a fitting characteristic of the Fruit of the Spirit to explore with our students this week. We encouraged them to reflect on how their attitudes in ‘times of waiting’ can be used to glorify God. Every day presents countless opportunities to practice and grow this virtue. We discussed common challenges, such as long queues, traffic jams, slow Wi-Fi, or simply counting down to a holiday.

Learning to be patient, with ourselves, with others, and with the Lord's timing, are not easy tasks, but they are essential to our faith walk. The Bible is rich with lessons on this topic, powerfully illustrating the boundless patience God extends to His people.

We encourage you to discuss with your child what they find challenging to wait for and how they can choose a God-honouring attitude instead!

SocS

Next week our students will enjoy their final SocS puppet show for the year. We are incredibly thankful to Mrs Diana Moes, who has written this unique, three year program, which explicitly teaches our Kinder to Year 2 students how they can positively interact with each other and continue to grow to be more and more like Jesus. It covers four main topics: understanding school rules, making friends, dealing with emotions and resilience. We are thankful for our Year 9 students who will also be supporting this program next week by facilitating discussion groups within the puppet play around the theme of ‘Good attitudes’, based on the Fruits of the Spirit. I encourage you to look out for the handout that will come home which contains a summary of the play and theme, along with some helpful follow-up discussion ideas for your family to continue the learning at home.

Mrs Ruth Cooper

Head of Junior School

News

A sea of creativity: Year 10 artists inspired by Bondi’s sculptures

A sea of creativity: Year 10 artists inspired by Bondi’s sculptures

Year 10 Visual Arts students recently enjoyed a wonderful day exploring Sculpture by the Sea, the world’s largest annual outdoor sculpture exhibition, set along the scenic Bondi to Tamarama coastal walk. The exhibition featured over 90 sculptures by artists from Australia and around the world, transforming the coastline into an open-air gallery of creativity and imagination.

Students spent the morning wandering the coastal path, viewing and discussing the diverse range of artworks. Students experienced both large-scale installations and delicate, thought-provoking forms that responded to the ocean and landscape. They were encouraged to reflect on how the artists used materials, space and the environment to communicate ideas.

In the afternoon, the group gathered at Tamarama Beach to create a series of observational drawings inspired by the sculptures and surrounding landscape. This provided a wonderful opportunity to slow down, observe closely and translate their experiences into sketches.

The excursion was both inspiring and educational, offering students a chance to connect classroom learning with real-world art practice. It was a memorable day filled with creativity, conversation and appreciation for contemporary sculpture in an extraordinary setting.

Mrs Annika Hackfath

Visual Arts Teacher

Young thinkers excel at the Mindquest enrichment program

Young thinkers excel at the Mindquest enrichment program

Congratulations to Rosalie Strate from Year 3 and Cullen Hamlin from Year 5, who have been recognised for their participation and engagement during the Mindquest weekend program, held in September. Mindquest is a two day enrichment program for primary students from Years 1- 6.

Cullen participated in the “Trial by Jury” and displayed excellent ability to think quickly and effectively in cross-examination. “I really liked learning new things about courts, the law and learning how to formulate arguments.” - Cullen

Rosalie participated in "Clear As Crystal" and was commended for her excellent engagement and enthusiasm towards her learning. “ I like Mindquest because I get to make new friends” - Rosalie

If you are interested in your child participating in one of the courses on offer at Mindquest, we advertise the weekends through our newsletter, in March and August each year, or you can contact me directly for more information.

Mrs Leonie Hampson

Junior School Enrichment Coordinator

Young writers shine in the NSW WriteOn competition

Young writers shine in the NSW WriteOn competition

The NSW WriteOn Competition for students in Years 1 to 6 offers a wonderful opportunity for young writers to showcase their creativity and imagination. This year’s stimulus quote was: “Could they be changing?” A special congratulations to Georgia Bluhdorn (Year 3) and Lola Chalk (Year 6), who were selected as our school finalists for their outstanding submissions.

In 2025, the competition received 658 entries from 344 schools and home-schooled students across the state. We are proud to congratulate our Shire students who participated in this exciting challenge - using their imagination to craft interesting and engaging stories. Well done to all our talented writers!

Mrs Leonie Hampson

Junior School Enrichment Coordinator

A backstage adventure: students capture their creative crew experience

A backstage adventure: students capture their creative crew experience

Cullen and Zach recently took up the amazing opportunity to join the Creative Crew Program at The Pavilion, a new initiative designed to give students an immersive and educational backstage look at the makings of live theatre at the Play! Kids Festival. Take a look behind the scene in the video above.

Celebrating creativity in Dorothea Mackellar Poetry Competition

Celebrating creativity in Dorothea Mackellar Poetry Competition

A huge congratulations to every student who entered the 2025 Dorothea Mackellar Poetry Competition! This year’s competition received an incredible 8,500 poems from 5,800 students across 660 schools nationwide. Our school proudly contributed 58 poems, written by talented students in Years 3 to 6.

Students could choose to write on this year’s theme, “All the Beautiful Things,” or explore a topic of their own interest.

Well done to all our young poets for their creativity, imagination and willingness to share their unique voices! A big thank you also to the teachers who encouraged and supported students throughout the writing process.

Mrs Leonie Hampson

Junior School Enrichment Coordinator

Shire robotics students recognised at assembly for teamwork, grit and grace at nationals

Shire robotics students recognised at assembly for teamwork, grit and grace at nationals

The robotics teams from Shire Christian School returned from Nationals full of joy and pride after an inspiring weekend of competition. Competing against the best teams from across Australia at the RoboCup Junior Australia National Championships, our students demonstrated exceptional resilience, maturity and calmness under pressure.

Throughout the event, the Shire Robocup teams embodied the spirit of teamwork and community, encouraging one another, lending support during challenges, and celebrating each other’s successes. Their willingness to help, pray with, and cheer for one another was a testament to their character as much as their technical skill.

We are deeply grateful for the incredible support of our Robocup families, whose encouragement, practical help, and unwavering positivity have carried the teams and staff throughout the year. Their generosity and community spirit truly reflect the heart of Shire Christian School.

A special thank you goes to Felicity Veltmeyer and Chris Pinn for their tireless support and leadership. Their mentoring, care for students, and behind-the-scenes efforts across the year and during the competition weekend have been invaluable.

Robocup Junior Australia is a project-oriented educational initiative that sponsors local, regional, and international robotic events designed to introduce RoboCup to primary and secondary school children. Created in a true cooperative spirit, RoboCup Junior encompasses not only vital STEM skills but extends right across a school curriculum. The competition also addresses social development by encouraging sportsmanship, teamwork, cooperation and organisational skills. The committee in charge of our State and the National competitions are all volunteers, and it is truly a unique organisation, who work tirelessly to make sure the competition is of a high standard, encouraging and supporting teams and mentors cheerfully throughout the competition. We are so thankful to be able to participate in Robocup Competitions.

It is a privilege and an honour to mentor such amazing, creative and capable students. They were outstanding in all their competitions, and I am incredibly proud of each one of them. We give thanks to our Lord who sustained us throughout the weekend.

The achievements of our Robocup teams are a wonderful reflection of their hard work, dedication, and the strong school community that supports them.

Congratulations to all involved on an outstanding effort at Nationals!

Mrs Leonie Hampson

Junior School Enrichment Coordinator

Sport

Table tennis skills on display at Sydney Olympic Park competition

Table tennis skills on display at Sydney Olympic Park competition

Over 40 Shire students expressed their interest in making the squad of 20. Internal playoffs were held last term, and many of the squad have given up break time the past 3 weeks to sharpen their skills.

Sydney Olympic Park hosted the competition with plenty of learning for life disposition chat around the tables - noticing, collaborating, adjusting and capitalising were all on show from our students. Congratulations to;

Open Boys - Koda and Andrew - Semi Finalists

U/15 Boys - Rd of 16 - Teams - Jared and Matthew, Kobe and Nate, Jacob and Leo

Mr Troy Dixon

Secondary Sports Coordinator

Girls cricket team shows teamwork and spirit at state competition

Girls cricket team shows teamwork and spirit at state competition

Our girls cricket team travelled to Penrith last week to compete in the CSSA state girls cricket competition. In the lead up, the girls were enthusiastic about their net sessions and demonstrated good improvement with the ball and bat. Mrs Wilson was impressed with joy and teamwork on display from all the team.

Carissa and Heidi did a great job leading the team. While we didn’t progress into the semi final rounds, we will be back again in 2026.

Mr Troy Dixon

Secondary Sports Coordinator

State-level tennis triumph: Congratulations to Hannah and Ben

State-level tennis triumph: Congratulations to Hannah and Ben

Congratulations to Hannah and Ben on being selected for the CSSA State Tennis competition at Parramatta recently. Unbeaten on the day, but unfortunately rain ended the event early.

Thank you for the spirit and attitude you both carried yourselves with - back at it in 2026!

Mr Troy Dixon

Secondary Sports Coordinator

Barnabas Blog

Prayer Answered By Crosses

Prayer Answered By Crosses

I recently came across this poem by John Newton that I had stored on my computer from way back, and I found it to be both challenging and helpful. (I also found it can be sung as a song to the English traditional melody, ‘O Waly Waly’.)

I asked the Lord that I might grow

in faith and love and every grace,

might more of his salvation know,

and seek more earnestly his face.

’Twas he who taught me thus to pray;

and he, I trust, has answered prayer;

but it has been in such a way

as almost drove me to despair.

I hoped that, in some favoured hour,

at once he’d answer my request,

and by his love’s constraining power

subdue my sins, and give me rest.

Instead of this, he made me feel

the hidden evils of my heart,

and let the angry powers of hell

assault my soul in every part.

Yea, more, with his own hand he seemed

intent to aggravate my woe,

crossed all the fair designs I schemed,

blasted my gourds, and laid me low.

“Lord, why is this?” I trembling cried;

Wilt thou pursue this worm to death?”

“This is the way,” the Lord replied,

“I answer prayer for grace and faith.

“These inward trials I now employ

from self and pride to set thee free,

and break thy schemes of earthly joy,

that thou may’st seek thy all in me.”

A poem by John Newton, author of Amazing Grace, in 1779.

Rev Bruce Christian

Notices

Shire Storytime for Preschool Aged Children – Thursday 27 November

Shire Storytime for Preschool Aged Children – Thursday 27 November

Our next Shire Storytime is on Thursday 27 November. We love sharing our unique approach to learning and continuing to foster a love of reading in our little ones.

Feel free to spread the word to parents, carers and grandparents to bring along their preschool aged children for a taste of big school!

Children can come and explore our Junior School IRC, share a story with our librarian, as well as participate in a craft. The program will run from 9:30am to 10:30am.

For One Night Only – Still Time to Book Tickets – Thursday 13 November 7pm

For One Night Only – Still Time to Book Tickets – Thursday 13 November 7pm

We encourage all to come along and enjoy this night of excellent entertainment from our Secondary students.

Tickets are $10. If your child will need to sit with you prior to or after their performance, please be sure to also book a "student performer ticket" which is free of charge.

We are looking forward to this event. Don't miss out!

Employment Opportunities

Employment Opportunities

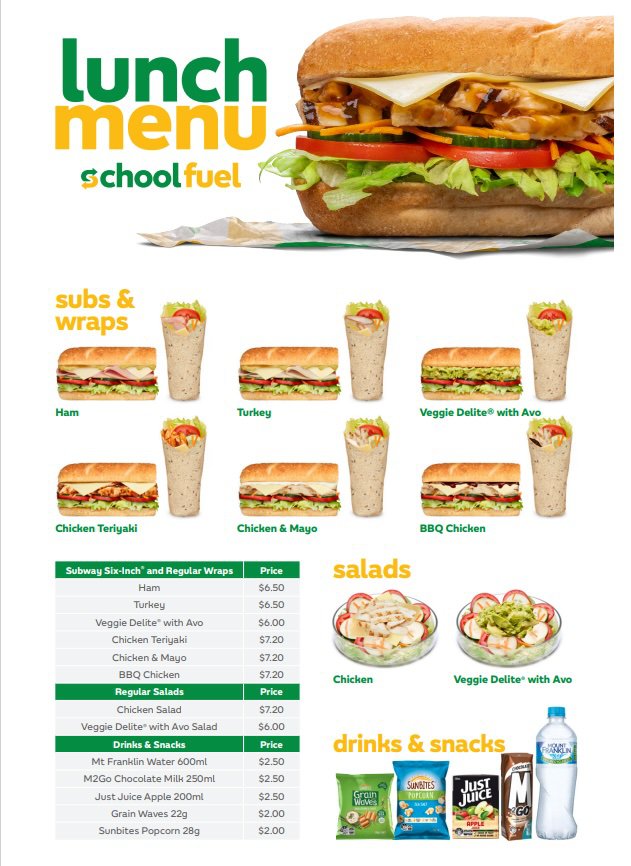

Subway available to order on Mondays and Fridays

Subway available to order on Mondays and Fridays

The Subway School Fuel lunch menu is now available to order via the My School Connect website or app.

Available on both Mondays and Fridays during term time, a select range of healthy lunch options from Subway is on offer, delivered to the school in time for Break 2.

Families can set up an account online or via the app using the instructions provided. Please set up a profile for each child to help us distribute the food.

Orders can be placed up until 8am on the day of delivery, an added convenience for families, now able to decide at the last minute to order lunch for their children. This time will be reviewed and adjusted if demand requires, and parents will be notified in advance by email.

While limited snacks are available on the School Fuel menu, parents should be aware that with delivery later in the day to keep the food fresh, snacks should still be provided for Break 1.

Junior School students will have their orders brought to their classroom. Secondary School students can collect their order during Break 2 (12:27pm) in the Year 12 area outside Student Services. Secondary students are responsible for collecting their orders from this location.

The partnership with Subway, with lunch available on Mondays and Fridays, will be trialled for all of Term 3. We hope this arrangement will provide a healthy convenient option for our families.

What's on - Term 4, Week 5 and 6

What's on - Term 4, Week 5 and 6

| Calendar | Junior School | Secondary School |

| Week 5 Mon 10 Nov | CSSA Yr 5/6 Basketball Gala Day | Yr 12 Sign Out Day |

| Tues 11 Nov | SocS K-2 Puppet Show | |

| Wed 12 Nov | Kindergarten 2025 Orientation 1 | Yr 12 Formal |

| Thurs 13 Nov | Shire Runners | For One Night Only Evening Event |

| Fri 14 Nov | ||

| Week 6 | ||

| Mon 17 Nov | CSSA Yr 3/4 Basketball Gala Day | |

| Tues 18 Nov | Yr 9/10 Drama VTR Forum Theatre Workshop | |

| Wed 19 Nov | Kindergarten Orientation 2 | |

| Thurs 20 Nov | Yr 7 2026 Orientation | Shire Christian Runners |

| Fri 21 Nov | Yr 4 Excursion Science Forces | Yr 10 Social Cruise |

The school calendar can be viewed in full via Compass.

Confidential Feedback

Confidential Feedback

We welcome your thoughts, suggestions and concerns to help us improve at Shire Christian School. Click here to make a submission.

Edstart - an alternative fee payment option

Edstart - an alternative fee payment option

Shire Christian School is pleased to offer an alternative payment option to assist families with managing their school fee payments.

Edstart helps make it easy for you to manage school fees by providing flexible payment plans. You can reduce your annual school fee spend by extending payments over a longer period.

With Edstart, you can fund tuition fees, additional charges such as uniforms, extra-curricular activities as well as amounts in arrears.

To find out more, visit edstart.com.au/shirechristian.

Please note that in providing information about Edstart, the school is not providing any recommendation, brokering or advice services. The school does not receive referral fees, commissions or any other remuneration from Edstart.

Community

For prayer and praise

For prayer and praise

"Finally, brothers and sisters, whatever is true, whatever is noble, whatever is right, whatever is pure, whatever is lovely, whatever is admirable - if anything is excellent or praiseworthy - think about such things. Whatever you have learned or received or heard from me (Paul), or seen in me - put it into practice. And the God of peace will be with you” Philippians 4:8 & 9

- Pray that our minds would be set on that which is true and noble, right, pure, lovely and admirable and that we will learn from the writings and example of the apostle Paul.

- Pray for the students who have now completed the HSC exams and pray for an enjoyable evening next week at their formal.

- Thank God for SHINE and FONO and for all the students and teachers involved.

- Pray for families in our school community experiencing times of anxiety, loss or family upheaval.

- Pray for continued safety as students and staff travel to and from school each day.

Shire Christian School Business Directory

Shire Christian School Business Directory

We are pleased to provide a directory of businesses with family or alumni connections to Shire Christian School (businesses of current parents, former parents, former students).

The directory is available on our website and will continue to become more useful over time as families register their businesses.

The initiative is designed to build community, encourage support for our families who are business owners and provide access to goods and services from within our community.

If you’re going to spend anyway, why not spend with a local Shire Christian School connected business and invest in your community.

View the directory on our website or register your business.

Toys and Tucker at Menai Anglican

Toys and Tucker at Menai Anglican

Menai Anglican is once again supporting Anglicare’s Toys ‘n’ Tucker drive, collecting food and gifts for those who would otherwise go without.

Through Toys ‘n’ Tucker, Anglicare Sydney provides a way for churches, schools, businesses and community groups to share the joy of Christmas and demonstrate God’s love by providing food and gifts for families in need.

Wondering What to Give?

Non-perishable food items such as:

- Christmas cake or pudding

- Long life custard

- Tinned ham

- Canned fruit and vegetables

- Rice, pasta or lentils

- Instant noodles (bag, not cup)

- Tea, coffee and Milo

- Long life milk

- Shortbread and biscuits (avoid chocolate covered ones as they melt)

- Jam

- Tinned salmon or tuna

- Pancake/cake mix

- Jelly crystals

- Muesli bars

- Lollies (no chocolate please, it will melt!)

Standard sizes are preferred to help everything fit in neatly. Any donation is gratefully received, but it is helpful if pork, gelatine, alcohol or items that easily crush or melt can be avoided.Toys (new) for children 0-18 years. Below are some gift ideas:

- Preschoolers: educational toys, games, picture books

- Primary school age: toys, outdoor games, sporting equipment

- Teenagers: vouchers/gift cards, sporting equipment, toiletry packs

Anyone can drop donations at Menai Anglican Church anytime before 5pm on Sunday, 23rd November 2025.

Donations can be dropped off 24 hours at the main church entrance, just look for the signposted gazebo.

Find Menai Anglican Church at 1 Broughton Pl, Barden Ridge. After entering the carpark, follow the signs to the main entrance, and pull up in the turning circle roundabout or park your car in a parking space. Don’t have time to shop? Give a hamper or gift online directly through Anglicare’s Toys ‘n’ Tucker shop. Find out more here.

🎁 Operation Christmas Child – Pack a Shoebox Online!

🎁 Operation Christmas Child – Pack a Shoebox Online!

While Operation Christmas Child Shoeboxes aren't being collected at our school this year, families who wish to participate can still do so individually through the “Build a Shoebox Online” option.

Operation Christmas Child is a meaningful way for Australians and New Zealanders to share love and joy with children in need around the world. Shoeboxes are filled with toys, hygiene items, school supplies, and other fun gifts – and every box is an opportunity to show a child they are cared for.

Build a Shoebox Online makes it easy to get involved from home. For $45 (including shipping), you can select gifts for a boy or girl, choose the age group, and even add a personal note and photo. It’s a simple and heartfelt way to make a difference.

👉 Start building your shoebox at buildabox.org.au

🌱 Beyond the Box – The Greatest Journey

Every child who receives a shoebox is invited to take part in The Greatest Journey, a 12-lesson discipleship program where they learn more about the Gospel in their own language. Through stories, memory verses, and group activities, children explore what it means to follow Jesus and share His love with others.

For just $12.50, donors can help cover the cost of a child’s participation, which includes:

- A workbook and beautifully illustrated children’s Bible

- A graduation certificate

- Training and resources for local teachers

Since its launch, over 46 million children have enrolled in The Greatest Journey, with many making life-changing decisions to follow Christ.

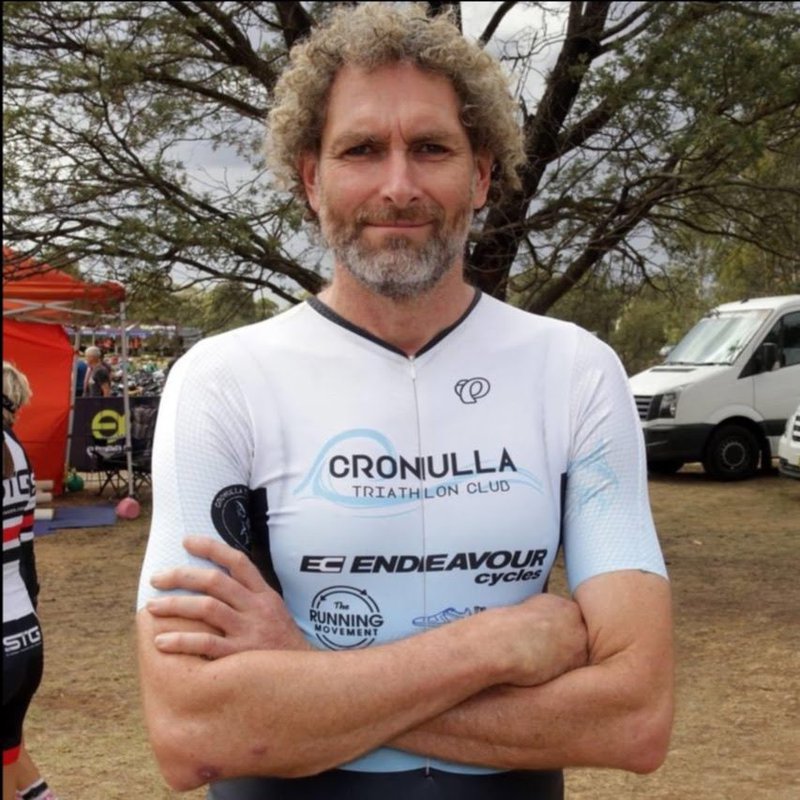

Stu Ford Memorial Challenge

Stu Ford Memorial Challenge

Cronulla Triathlon Club have organised another Stu Ford Memorial Challenge for 22 November 2025. This year they are partnering with local event “The Shire Run Carnival”. The Shire Run Carnival is hosted by CTC Life member Nathan Breen and joint charity partner Love Mercy.

This special event honours the memory of Stu Ford whilst raising money for his two favourite charities: Love Mercy and The Black Dog Institute.